BlackRock Revises Crypto ETF Documentation

BlackRock has revised its crypto ETF documentation to address both long-term risks and product efficiency. In a recent filing, the firm flagged quantum computing as a theoretical threat to Bitcoin’s cryptographic integrity — a precautionary note that reflects growing industry awareness, though experts like Bloomberg’s James Seyffart describe it as standard disclosure.

In-Kind Creation and Redemption for Ethereum ETF

In a separate update, BlackRock introduced in-kind creation and redemption to its proposed Ethereum ETF, allowing investors to swap ETF shares directly for ETH instead of cash. While the SEC has yet to greenlight this model, analysts expect approval could come by October.

READ MORE:

Bitcoin Miners Show Restraint as Price Eyes New Highs

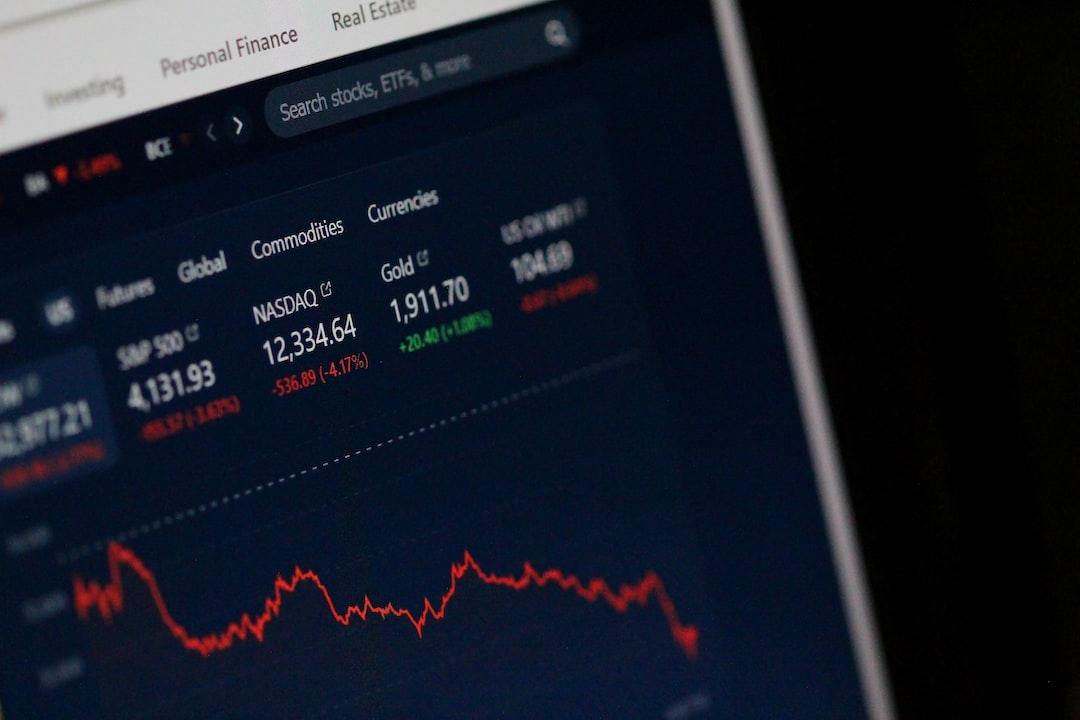

These adjustments follow BlackRock’s recent discussions with the SEC on staking and tokenization, reinforcing its role in shaping the regulatory path for crypto ETFs. Meanwhile, its iShares Bitcoin Trust (IBIT) continues to dominate the market with over $5.1 billion in inflows across 19 straight days — underscoring institutional confidence despite emerging tech risks.

Strategic Positioning in the ETF Landscape

The firm’s dual-track strategy—addressing future security while modernizing fund structure—highlights its ambition to lead the next evolution of crypto investing. By preemptively adapting to quantum concerns and pushing for efficient redemption models, BlackRock is positioning itself as both cautious and forward-thinking in an increasingly competitive ETF landscape.

Alexander Stefanov